A market cap of 68.5B USD. A fine of 41M USD. Is Tether’s USDT a slam or scam?

Understand how USDT works, ways Tether makes money, and whether you should consider USDT as an investment. All in 3 minutes.

This is part 2 of stablecoinwar. Let’s dive in. 🧵

Let’s take a quick moment to refresh our 3C framework. We are using our house party analogy from part 1. No worries if you have not read that- we will do a quick review!

So- what’s the house party analogy?

You are hosting a house party and you’ll like to invite your crush over. 🫶

You also know that your crush is likely to agree if you have your cool homies over so that she can bring her girlfriends too!

Now that we have set things up, a quick refresher on 3C. 👨🏫

A quick 3C refresher

Our first C is collateral. Do you have the homies to back you up at your party?

Our second C is capital efficiency. Are your homies flaky? Do you need to invite more of them than your house can fit?

Our third C is centralisation- does a single person call all the shots?

3C applied to USDT

We’ve also learnt that USDT is a fiat-backed stablecoin. It is

collateralised with fiat money

capital efficient since it just needs to have 1 USD for every USDT

highly centralised, because Tether is managing all the assets

Time to see how USDT works!

USDT’s mechanics

Because USDT is a fiat-backed stablecoin, it has 2 distinct components. Take a quick guess!

If your answer is “fiat” and “crypto”, you’re right! ✅

I’m going to provide you with an awesome drawing that shows you how all the components work together. But before that, let’s quickly go through the “fiat” component.

Fiat component of USDT

Tether works with traditional banks that accept USD deposits from clients.

It’s really similar to how you purchase items online- you need o work with banks that will settle the payment between you and the merchant.

Straightworward yea? Crypto component next!

Crypto component of USDT

USDT is available on 13 crypto protocols. They include:

Bitcoin’s OmniLayer

Bitcoin’s Standard Ledger Protocol

Ethereum

Polygon

Solana

Algorand

Avalanche

NEAR

Ok, that was a long list. Thankfully, the explanation is shorter.

USDT is either in circulation or in Tether’s treasury on those protocols. Some quick definitions-

“in circulation”: anyone can buy or sell

“in treasury”: will only be released for circulation when consumers deposit USD into Tether’s bank accounts

Here’s the overview of USDT!

Overview of USDT

At the top, there’s the crypto ecosystem (in green).

At the bottom, there’re the traditional banks (in blue).

Tether and its users work with both systems. The orange arrows show the process of USDT issuance. Let’s look at step 1.

Step 1 (Authorise tokens)

Tether uses a multi-signature model to mint new USDT. A multi-sig model needs a few people to approve the mint, which prevents individuals from abusing the system and spamming mints. 😈

What happens to the newly minted tokens?

Step 2 (Issued but unauthorised USDT in treasury)

They are stored in the treasury on the respective crypto protocols (e.g. Solana, Ethereum). More concretely, these USDT tokens belong to Tether’s wallet.

Why do you want idle USDT sitting in treasuries?

For Tether, having the treasury reduces the number of times they have to use their private keys to mint new USDT (e.g. they can mint 100M USDT while each user may pay for 3-5M).

This reduces the risk of leaking their private keys.

There’s also a benefit to users!

Because the USDT is already minted, users can receive it much faster. Imagine waiting for USDT to be minted when Yuga Labs launch some project on Ethereum- good luck with that!

Alright, let’s look at step 3, which involves traditional banks. 🏦

Step 3 (Depositing money into Tether’s bank account)

Users who wish to purchase USDT from Tether will just need to deposit their USD into banks that work with Tether.

This helps to ensure that USDT is fully collateralised (it has 1 USD for every USDT authorised). What’s with the rumors of USDT being under-collateralised though? We will explain that in a bit. Let’s first finish reviewing our drawing!

Step 4 (Users get USDT)

This is self-explanatory. Users will get USDT on their preferred blockchain!

Ok, it’s time to look at how Tether makes money, and why some suspect that USDT is under-collateralised.

Tether’s money making scheme

Tether makes money through 3 methods.

Fees.

Tether charges clients fees for account verification and fiat deposit/withdrawal. Nothing fishy here. What about the other 2 methods?Loans to other companies (commercial paper)

Investments (including certificates of deposit, where you put money into a bank for a fixed time to get interest)

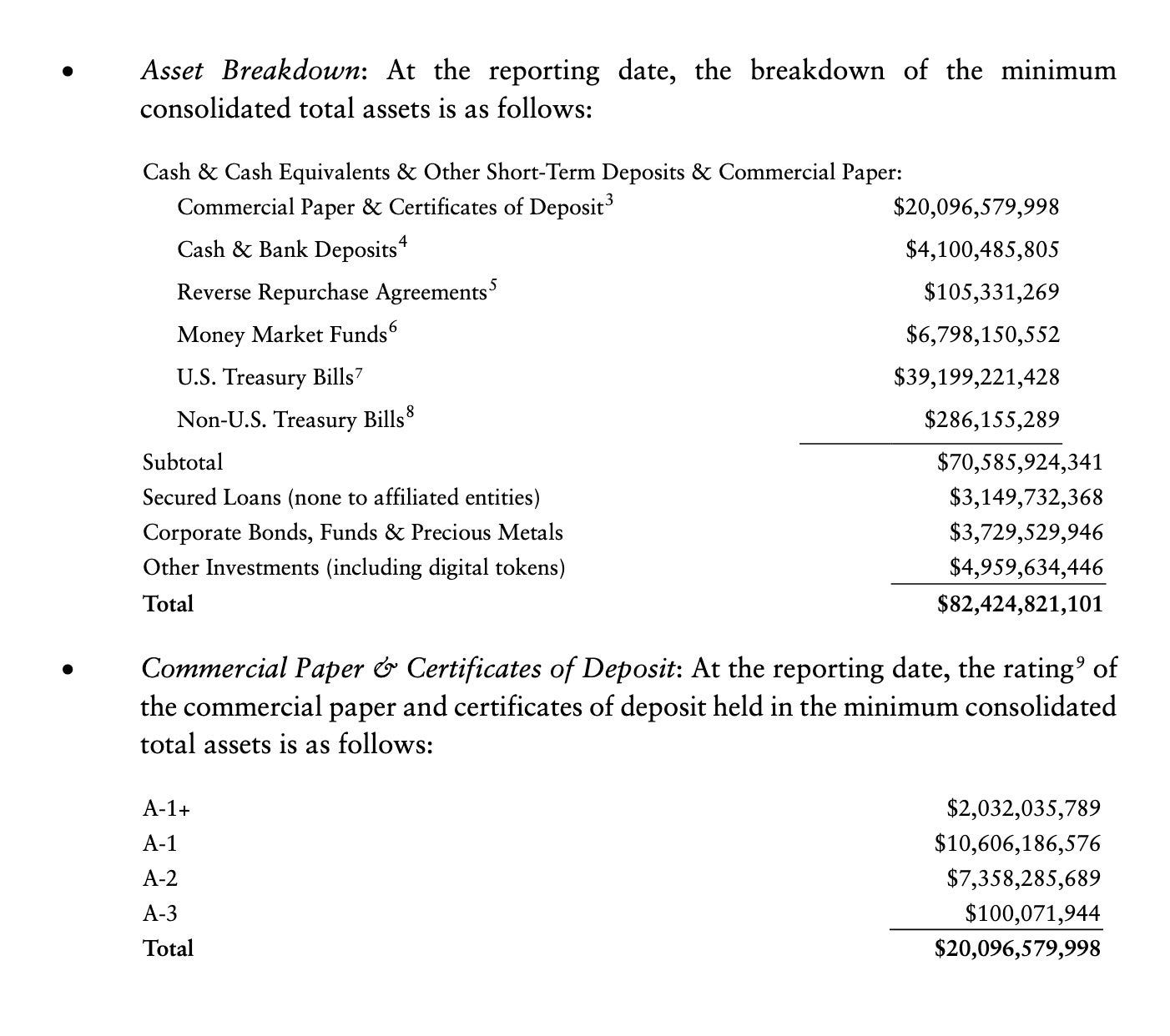

Here’s a quick look at Tether’s reserves report from March 2022.

The 20B statement worries investors. Because commercial paper and certificates of deposit are more illiquid, it is harder to convert this asset to cash to support the peg.

From the report, the average duration to turn these assets to cash is 44 days. Remember the UST saga?

UST and LUNA crashed in 72 hours. 44 days is light-years compared to that.

The right lens to view USDT

You used to be able to earn up to 12% interest when you deposit USDT on platforms like BlockFi and Celsius Network. However, events like Celsius Network freezing withdrawals remind us such behavior is an asymmetric bet- you may earn a little more on interest, but can stand to lose the whole asset.

Fundamentally, I believe that USDT should be used for fast crypto transactions, and not as an investment tool.

If this thread was helpful, please subscribe and share it with your friends!